AMTD Research | China Property: companies that are undergoing organizational changes or with unique competitive edges, could be the sign of an up-and-coming multi-year outperformer

AMTD Property Research released a 40-page in-depth report of China property industry. Investors should adopt a bottom-up approach to pick stocks, based on a developer’s execution capability improvement, instead of an asset allocation approach. AMTD Property Research team believes that companies that are undergoing organizational changes or with unique competitive edges, could be an up-and-coming multi-year outperformer.

Bottom-up approach to identify multi-year outperformers

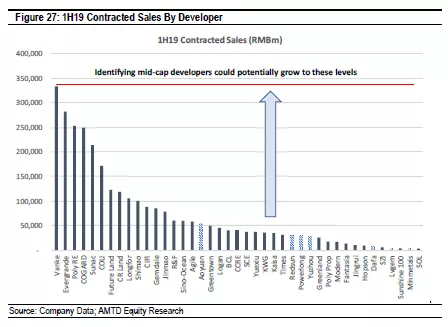

Market has de-rated the China Property Sector to 6x Fwd P/E and 1.3x P/B, reflecting the fundamental challenges the industry is facing, including property tightening policies and demographic dividend. Assuming that there will no longer be any policy stimulus to the China Property industry, we believe the industry’s total annual sales is approaching a market ceiling during the next 2-3 years. We believe investors should move from picking stocks based on exposure (Tier-1,2,3 cities) to a more bottom-up execution oriented approach, to identify the up-and-coming multi-year outperformers. We initiate/assume coverage of eight HK-listed property stocks with Aoyuan (3883.HK) and Powerlong (1238.HK) our top picks of the sector, while Dafa Properties (6111.HK) is one for long term.

Pick companies on execution instead of asset allocation approach

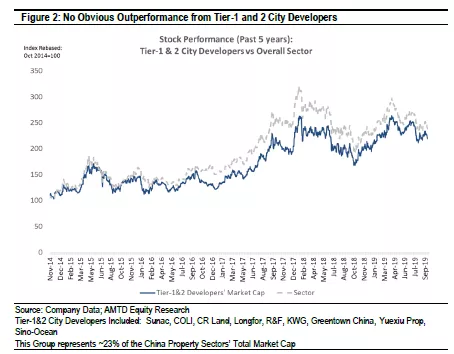

One of the market consensus over the past few years in stock picking has been a preference towards developers with Tier-1 and 2 city exposures, over Lower-tier cities. We believe this is over-simplistic and would not have yielded outperformance in the past 5 years (Figure 2 and 3). We found by case study that organisational changes within a company could often become a springboard resulting in a multi-year contracted sales growth, driving stock performance.

Organisational changes start from the top

We identify Aoyuan as a developer who have seen top-level management changes in the past 2-3 years, and the results of the changes implemented have begun to reflect in their contracted sales growth. We believe they are still in the middle of a multi-year growth period, with 2019E contracted sales still expected to grow by ~25% YoY. Once the pre-sold properties are delivered and recognized on financial statements in the next 12-24 months, we believe it will result in a next wave of share price outperformance. Behind Aoyuan, Dafa Properties (6111.HK) is another name that we believe market should pay more attention to, having appointed a new CEO in 2018, who was ex-Shimao COO.

Demographic dividend peaked, property sales approaching a ceiling

The working population (15-64 year olds) in China has peaked in 2014 and the downtrend has already begun. This together with urbanization demand have been key fundamental drivers of the industry in the past twenty years. Losing one of the key engines, would mean that we are very likely to be close towards a market ceiling in terms of National Residential Sales Volume, which reached 1.479bn sqm in 2018.

Far East Consortium (0035.HK)

We maintain a Buy Rating of Far East Consortium with a Target Price of HK$4.21/sh. Far East offers a diversified portfolio of property assets and project execution capabilities across Hong Kong, China, Australia, UK and Malaysia. Australia and UK Resi/Com/Hotel assets contributes to 24% and 16% of the company’s NAV. Far East Consortium has one of the most diversified portfolio of assets across the HK/China property companies.

China Aoyuan (3883.HK)

We maintain a Buy Rating of China Aoyuan with a Target Price of HK$14.35/sh. Stock is trading at attractive valuations of 3.5x 2020E P/E, in a low end. China Aoyuan reported a solid set of 1H19 results, with revenue growing by 73% YoY and net profit grew by 79% YoY, while 2H19 contracted sales momentum remains strong and will be a key catalyst driving share price higher.

Yuzhou Properties (1628.HK)

We initiate coverage of Yuzhou Properties with a Buy Rating and a Target Price of HK$3.96/sh. 2019E earnings growth is flattish, but we expect growth to pick up in 2020E. Dividend yield of ~8.6% is attractive, considering that it is at similar levels to the YTM of 2023 Senior Notes.

Powerlong (1238.HK)

We initiate coverage of Powerlong with a Buy Rating and a Target Price of HK$7.18/sh. We believe the company’s commercial properties development and operations is a competitive edge in acquiring profitable development opportunities. We expect a 2018-2021E Net Profit CAGR of 42%, which is among the highest in our coverage universe.

LVGEM (China) Real Estate (0095.HK)

We initiate coverage of LVGEM China with a Hold Rating and a Target Price of HK$2.79/sh, as we believe the stock is already richly valued. With a key focus in Shenzhen Urban Redevelopment Projects, Lvgem has one of the highest profitability across our coverage universe with 2019E GP Margins reaching ~70% and a net margins of ~22%. Earnings growth outlook is also strong as we estimate a ~35% 2018-2021E Net Profit CAGR. However, we are concerned with the company’s balance sheet leverage with 1H19 Net Debt to Equity of 120%.

Dafa Properties (6111.HK)

We initiate coverage of Dafa Properties with a Buy Rating and a Target Price of HK$6.98/sh. We expect the company’s contracted sales growth will improve, driving share price higher, as the CEO Mr. Liao Lujiang (ex-Shimao COO) improves the company’s operational efficiency, bringing his experience from Shimao.

Redsun Properties (1996.HK)

We initiate coverage of Redsun Properties with a Buy Rating and a TP of HK$3.32/sh. As of 1H19, Redsun has RMB23bn of contract liabilities (pre-sold proceeds) on their consolidated balance sheet, which represents ~158% of our 2019E revenue, so we believe the revenue of 2019E-2020E is highly secured. The stock is now trading at 3.7x 2020E P/E.

Minmetals Land (0230.HK)

We initiate coverage of Minmetals Land with a Hold Rating and a Target Price of HK$1.14/sh. We expect the developers’ net profit growth to remain flattish during 2018-2021E with a CAGR of 3%. In terms of solvency, Minmetals Land has a healthy balance sheet with a 1H19 Net Debt to Total Equity of 74%. Its weighted average borrowing costs is only at 4.92% in 1H19, lower than industry average.