AMTD Group's investment banking platform AMTD International H1 and Q3 2019 financial reports: in the Q1-Q3 2019, it achieved revenue of HK$1.04 billion and net profit of HK$740 million, realizing annual goals ahead of schedule

Although the international capital market fluctuated in 2019, AMTD Group's investment banking platform AMTD International (NYSE: HKIB), Asia's largest private investment bank, still achieved fruitful results over the past three quarters. The number and scale of capital market transactions completed throughout the whole year both surpassed last year, and achieved a new record in operating performance, realizing the full-year target of 2019 in advance. In 2019, AMTD International, as the Global Coordinator and / or Bookrunner (a senior role in the underwriting syndicate), completed 24 Hong Kong and US IPOs and equity capital market transactions, with a total financing amount of more than US$4.6 billion, consisting of 16 Hong Kong IPOs, 6 US IPOs and 2 block trades. These transactions include assisting two Chinese regional banks, Jinshang Bank and Bank of Guizhou, to go public on the HKEX as the only JGC besides deal sponsors, Maoyan Entertainment’s HK IPO, the first IPO in China’s Internet Entertainment Services industry, Feihe Group’s HK IPO, the largest IPO in dairy industry in the history of HKEX, CMGE Technology’s HK IPO, a transaction with one of the largest locked capitals this year, Shanghai Henlius Biotech’s HK IPO, the largest IPO in biotech industry, and FangDD’s US IPO, the first IPO in real estate SaaS industry. At the same time, AMTD International, as the Global Coordinator and / or Bookrunner, has completed 24 international debt capital market transactions with a total financing amount of more than US$ 6 billion, including the first overseas preferred shares issuance by Guangzhou Rural Commercial Bank, and the largest second-tier capital bond offering in Hong Kong market banking sector in ten years issued by Nanyang Commercial Bank.

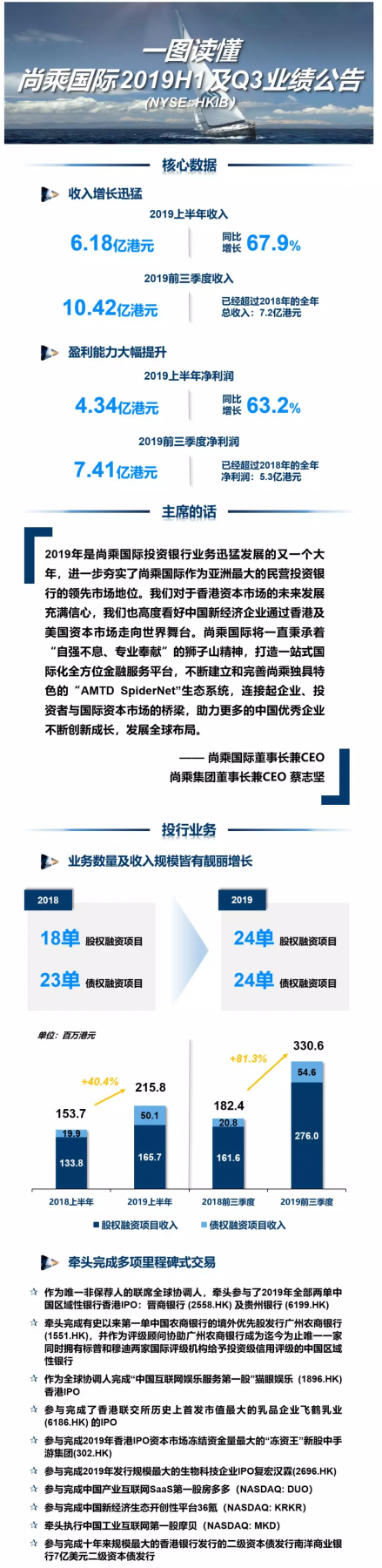

In the first six months of 2019, AMTD International achieved HK$618 million in revenue, an increase of 67.9% year on year; in the first nine months of 2019, it achieved revenue of HK$1,042 million, which has exceeded the full year revenue of 2018 (HK$720 million); in the first six months of 2019, AMTD International achieved net profit of HK$434 million, an increase of 63.2% year-on-year; in the first nine months, it achieved net profit of HK$741 million, which has exceeded the full year net profit of 2018 (HK$530 million). The rapid business growth, strong profitability and remarkable financial results reflected the strength of AMTD International as a leading independent investment bank in Asia to provide clients with professional services in the international capital market, especially in the acquisition of high-quality projects, the expansion of financing tools in capital markets, the layout of global capital market networks and resources, and the enhancement of asset management scale and efficiency.

Revenue and profitability of AMTD International's core business segments are exceedingly robust. In terms of investment banking, in the first six months of 2019, investment banking achieved revenue of HK$216 million, an increase of 40.3% year-on-year; in the first nine months of 2019, it achieved revenue of HK$331 million, an increase of 81.3% year-on-year. In terms of asset management business, in the first six months of 2019, the asset management business achieved revenue of HK$61.18 million, an increase of 36.3% year-on-year; in the first nine months of 2019, it achieved revenue of HK$91.44 million, an increase of 42.2% year-on-year; AMTD International's assets under management amounted to HK$24.4 billion, an increase of 33.8% over the end of 2018. It can be seen that investment banking business and asset management business, as the two major engines of AMTD International, continue to bring rapid growth in cash flow income. Underwriting fees, asset management fees and handling fees are the main sources of income. This structure has the advantages of high income quality, high operating efficiency, low capital consumption, and low risk reserves.

Recently, AMTD International has also announced the issuance of 7,307,692 Class A ordinary shares and 4,526,627 Class B ordinary shares at the price of US$8.45 per share and a total financing size of US$100 million; at the same time, a private placement of convertible notes due in 2023 with issuance size of US$15 million was issued. This is another international capital market financing transaction completed after AMTD International’s listing on NYSE in August 2019, which raised US$ 200 million. In less than half a year after being listed, AMTD International has completed the remarkable issuance of new shares and convertible notes, demonstrating the support and optimism from global capital markets towards AMTD International, especially from long-term investors and the wealthy Hong Kong families.

Mr. Calvin Choi, Chairman and CEO of AMTD International, said that for AMTD International, 2019 was another great year, as we achieved rapid development in investment banking business and further consolidated AMTD International’s leading market position as the Asia’s largest independent investment bank. We are also highly optimistic that Chinese new-economy enterprises will go to the world stage through Hong Kong and the US capital markets. With the "Lion Rock" spirit of “continued self-enhancement, innovation and ambition”, AMTD International created a one-stop international financial service platform, and will continuously expand and improve our unique ecosystem, AMTD SpiderNet, which builds up the bridge between enterprises and international capital markets, in order to help more Chinese outstanding enterprises to grow, innovate and develop their global presence.