AMTD Intl completes dual-currency perpetual bond issuance

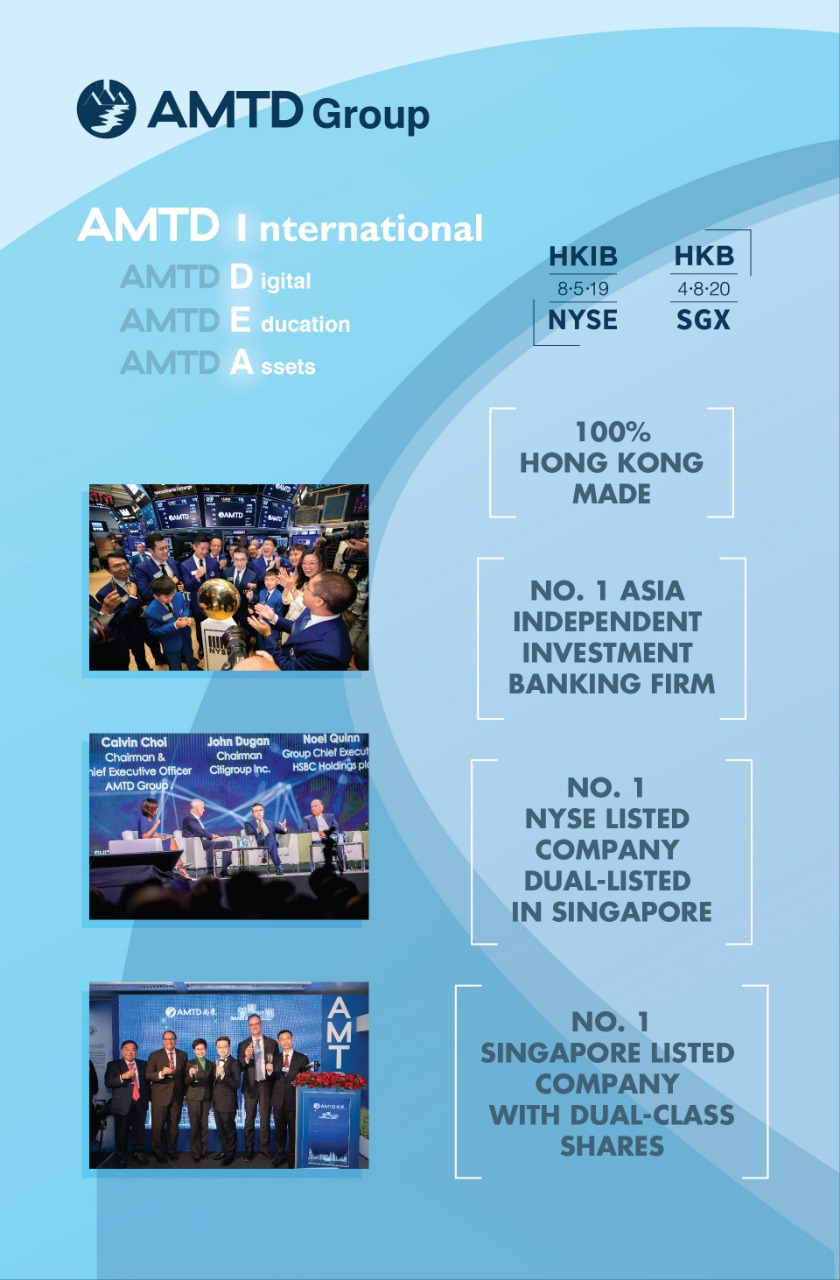

On May 7th 2020, AMTD Group's investment banking platform AMTD International Inc. (“AMTD International”, NYSE: HKIB / SGX: HKB), Asia's largest private investment bank, dual-listed on NYSE and SGX, completed US$200 million and S$50 million dual-currency exchange offer and the pricing of new perpetual bond issuance (the “Transaction”). Both tranches were drawdowns under the AMTD International’s US$1.0 billion medium term notes programme which is dual-listed on both the HKEX and the SGX, it is also AMTD International’s first ever debt capital markets transaction.

The Transaction is AMTD's first ever dual-currency issue and the first bond listed on both HKEX and SGX. It is a landmark transaction in the international debt capital markets:

-The first ever USD and SGD dual tranche exchange offer

- The first ever concurrent USD and SGD perpetual securities issuance

- The first ever Hong Kong financial institution issuing SGD perpetual securities

- The first ever Hong Kong issuer issuing SGD fixed-for-life perpetual securities

The issuer of the Transaction is AMTD International, AMTD Group's investment banking platform dual-listed on NYSE and SGX. As the Transaction was highly sought after in the international capital markets, bookbuilding and pricing of the new issuance was highly successful. The final pricing achieved for the USD and SGD tranches are 7.250% and 4.500% respectively. The USD tranche received over US$600 million of total demand at its peak, amounting to an oversubscription of nearly 4x. The inclusion of the SGD tranche was due to anchor reverse enquiries and marks an important step in further expanding into the Singapore capital markets, following AMTD International’s secondary listing on the SGX in April 2020.

In August 5th 2019, AMTD International was successfully listed on NYSE and became the first Hong Kong financial institution to be listed on U.S. market, as well as one of the five largest global independent investment banks measured by market capitalization. In December 2019, AMTD International completed a series of private placements of new shares and convertible notes, becoming one of the few new IPO Stocks which completed new share placement within half a year post IPO at a higher price than that of the IPO. On April 8th 2020, with the approval from SGX, AMTD International was officially listed on SGX, becoming the first company ever to be dual listed on NYSE and SGX, the first company featuring dual-class shares (“DCS”) listed on SGX, the largest financial institution domiciled in China and Hong Kong listed on SGX as measured by market capitalisation, the first Hong Kong financial institution listed on SGX, the largest company in terms of market capitalisation to list in Singapore this year so far and the first company to have a digital listing ceremony.

Despite the volatility in international capital markets in 2019, AMTD International achieved an upbeat set of results in 2019 with revenue of HK$1.20 billion (c.US$150 million) increasing 66.5% from HK$720 million in 2018 and net profit of HK$830mm (c.US$110 million) increasing 58.2% from HK$530 million in 2018. The total number and value of capital market transactions completed in 2019 both surpassed that of 2018 and reached a new height in AMTD International’s operating history.