HK FinTech 2020 | Virtual Banks Landscape in APAC

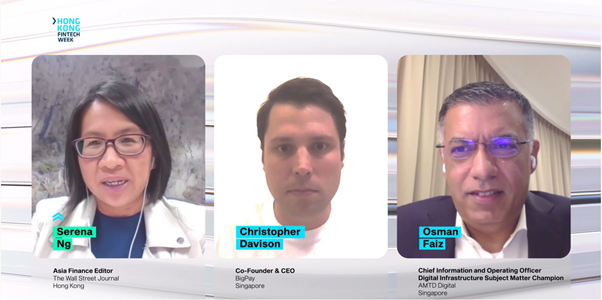

On the second day of the Hong Kong FinTech Week 2020, Osman Faiz, AMTD Digital Chief Information and Operating Officer and Digital Infrastructure Subject Matter Champion, was invited to speak on the panel “Virtual Banks Landscape in APAC” of Hong Kong FinTech Week, to discuss opportunities and challenges among the FinTech trend, and future prospect of virtual banks. The panel was moderated by Serena Ng, Asia Finance Editor of The Wall Street Journal. Christopher Davison, Co-Founder & CEO of BigPay, which is a Southeast Asia FinTech company, also attended the panel.

(From right to left) Osman Faiz, AMTD Digital Chief Information and Operating Officer and Digital Infrastructure Subject Matter Champion, Christopher Davison, Co-Founder & CEO of BigPay, Moderator- Serena Ng, Asia Finance Editor of The Wall Street Journal

Osman first introduced AMTD Digital as a fast-growing FinTech Ecosystem Platform player, aiming to build a one-stop, cross-market, multi-product, and comprehensive digital finance service platform. AMTD Digital has an in-depth understanding of APAC virtual banks landscape. In June 2020, together with Xiaomi Group, AMTD launched Airstar Bank, one of the eight virtual banks in Hong Kong.

Osman also mentioned that banking is a unique industry, of which the essential element is trust. How to secure data privacy and cybersecurity, and follow General Data Protection Regulation (GDPR) within current boundary, are the specific topics of this sector. Regulation on banks can hardly be cross-regional or cross-jurisdictional, yet virtual banks have the inherent advantages to comply with every local regulation. Christopher also stated that capital requirement varies among Southeast Asian countries, and thus it is of great significance to meet the local requirements while expanding business.

When talking about the future prospect, Osman pointed out that in five to ten years, driven by the development of digital infrastructure, intensified collaboration between public and private sectors, and increasing involvement of financial institutions and tech giants, we could foresee a huge growth in virtual banks. The upcoming 5G technologies would also improve financial inclusion and everyone can enjoy the convenience that it brings.